Business

WealthWise Employee Program:

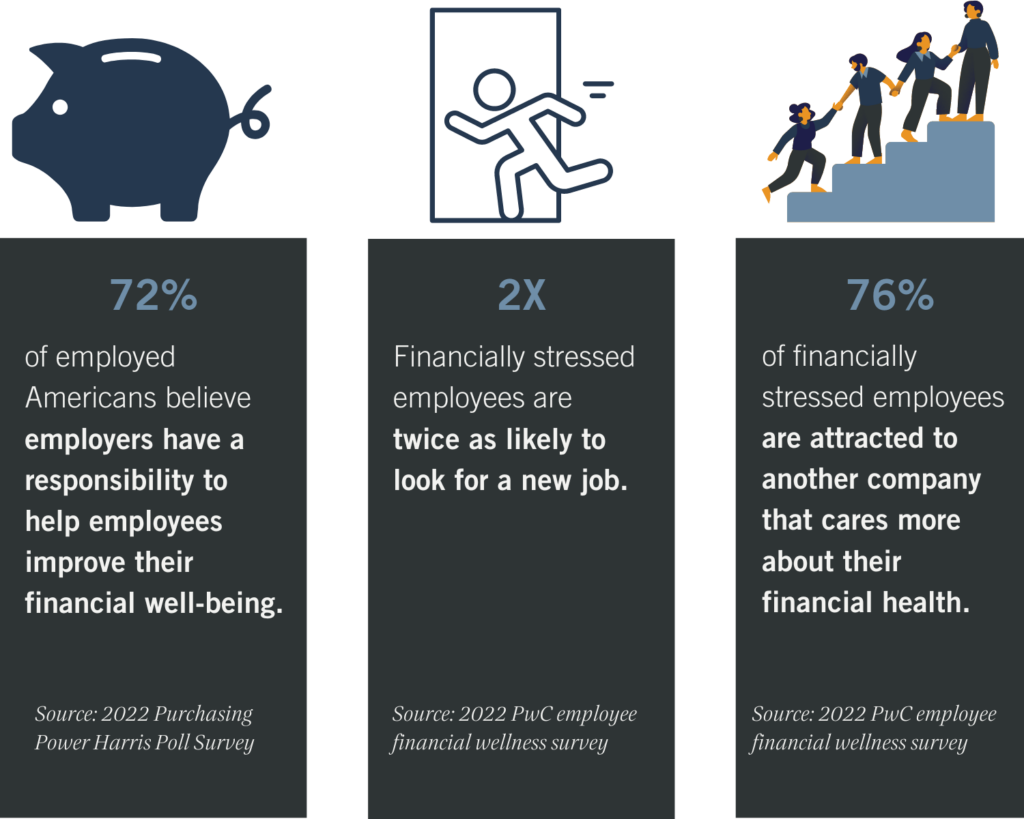

We know that you’re trying to support your team. But the truth is that a paycheck alone doesn’t guarantee workers financial stability in today’s environment. Like it or not, your team is looking to you to close the gap.

Help your employees achieve financial wellness and unlock their true potential with an Employee Wellness Program. We offer a unique approach to financial coaching, helping your employees build a strong financial foundation.

Our employee wellness programs are based on the following principles:

- Financial coaching tailored to your team, covering topics such as money management, budgeting, saving, and debt management.

- Creating actionable and realistic spending plans that align with your employees’ goals and values.

- Ongoing support and guidance to help your employees stay on track, overcome challenges, and celebrate successes.

Our employee wellness programs are beneficial for both employees and employers. You can reduce stress, turnover, and increase productivity by investing in your team’s financial wellness.

Don’t wait any longer. Contact us today to achieve financial wellness and success.

Ready?

Schedule a meeting today with Douglas Riegger.

Employee retirement:

Participating in employee retirement plans is crucial for a secure financial future. When you join such plans, like a 401(k) or a pension, you’re setting aside a portion of your income for retirement. It’s like planting seeds for a future harvest. First, your contributions often come with tax benefits, which means you can save money on taxes. Second, many employers match your contributions, essentially giving you free money. As your money grows over time, it compounds, which means it earns interest on the interest, making it grow even faster.

Transitioning your business

When it comes to selling your business, transferring it to key employees or family members, or retiring, planning can often become complex. It is important for business owners to have an exit plan. That’s where a financial professional with the Certified Exit Planning Advisor (CEPA) designation helps business owners decide the optimal time to sell and prepare for a smooth transition

Critical Areas of Focus:

- Value acceleration methodology

- Estate planning

- Private equity

- Charitable intent

- Key employee insurance and benefits planning

You benefit from working with a CEPA if you’re a business owner wondering how to prepare to sell your business. Even if you’re not ready to sell, CEPAs are often also financial professionals specializing in financial and tax planning for individuals with unique situations.

To learn more about the CEPA designation, go here:

Ready?

Schedule a meeting today with Rick Zich.